When Posting an Adjusting Entry to the General Ledger Write

Any hours worked. Trial Balance unadjusted For the month ended October 31 20XX.

Solved E Post Adjusting Journal Entries To T Accounts Chegg Com

This video follows the transactions you previously journalized.

. 4 When it is not feasible to correct the original entry a ledger adjustment should be utilized. When posting an adjusting entry the word adjusting is typically written in the item column. Posting from general journal to general ledger or simply posting is a process in which entries from general journal are periodically transferred to ledger accounts also known as T-accounts.

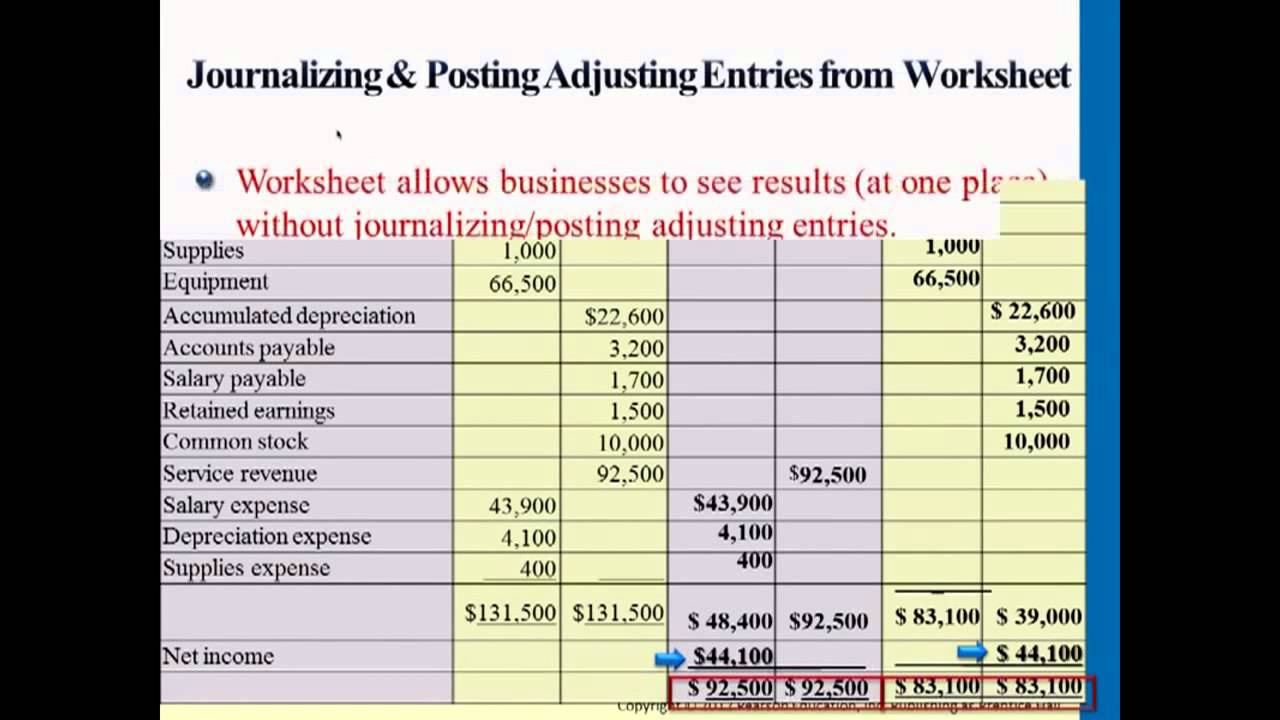

Adjusted trial balance can be used directly in the preparation of the statement of changes in stockholders equity income statement and the balance sheet. Incorporated entries on the both sides of this account. Or 3 as each journal page is filled.

When posting the general journal the date used in the ledger accounts is the date the. Four of the most common reasons for General Ledger adjustments are. Its important to note the purpose of the entry in the item description section.

But what does posting exactly mean. The accounts in the general ledger are classified into two general groups. After you make your adjusted entries youll post them to your general ledger accounts then prepare the adjusted trial balance.

Post Adjusting Entries to the General Ledger. Prepare the Financial Statements. If an amount box does not require an entry leave it blank.

What is a General Ledg. Lets start by reviewing NeatNikss trial balance for the month of October. Learn how to post transactions from the journal to the General Ledger.

T-accounts will be the visual. Posting adjusting entries is no different than posting the regular daily journal entries. Posting is always from the journal to the ledger accounts.

Postings can be made 1 at the time the transaction is journalized. Payroll is the most common expense that will need an adjusting entry at the end of the month particularly if you pay your employees bi-weekly. Prepare an Adjusted Trial Balance.

Prepare the Closing Entries. Do not ente until you complete part 2 GENERAL JOURNAL PAGE 5 DATE DESCRIPTION POST. All the debit accountsamounts involving in a transaction are recorded on the left side of while credit.

It is prepared at the end of every accounting period after all the transactions for the period have been recorded and posted to the general ledger. Make sure debits and credits are equal in your journal entries. Make sure to correct any errors youve found.

After the adjusting and closing entries 5. T-accounts form is given as under. 7 Financial Statements.

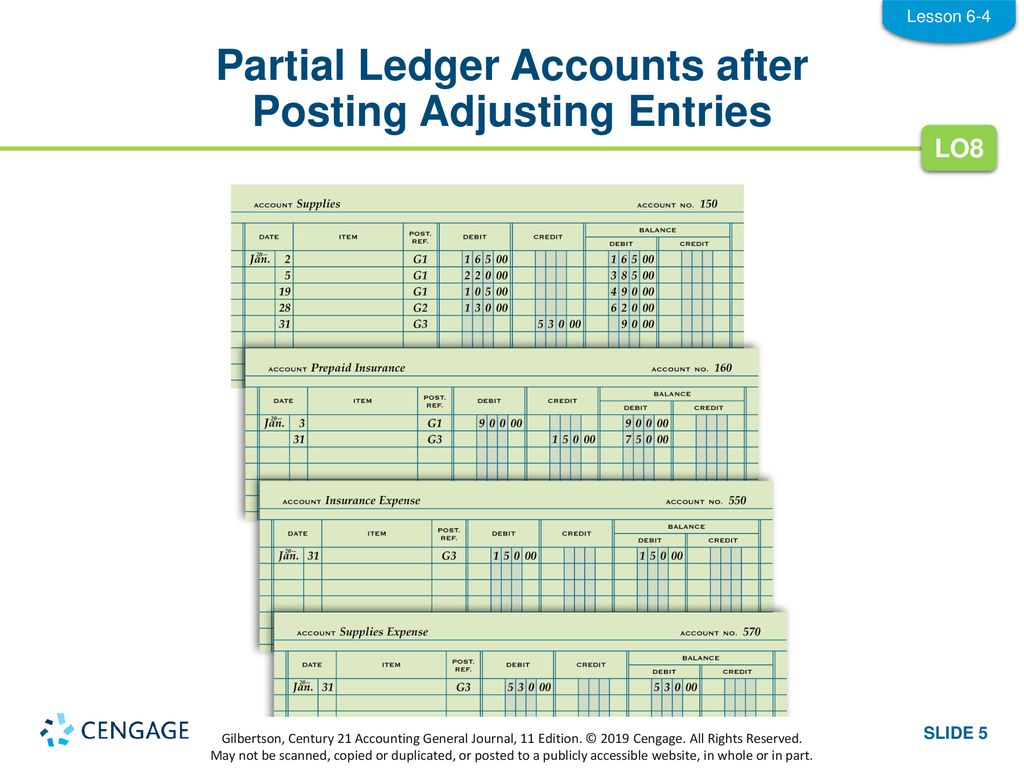

Balance in the work sheet. Once you have journalized all of your adjusting entries the next step is posting the entries to your ledger. This process is just like preparing the trial balance except the adjusted entries are used.

DEBIT CREDIT Adjusting Entries a. An adjusted trial balance is a listing of all the account titles and balances contained in the general ledger after the adjusting entries for an accounting period have been posted to the accounts. T-Accounts are actually graphic presentation or visual aid of General Ledger.

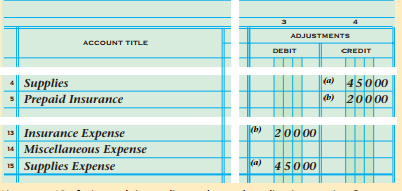

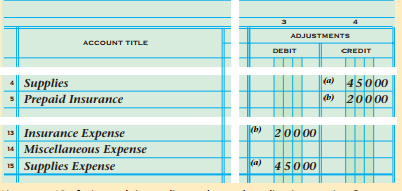

When posting an adjusting entry to the general ledger write adjusting in the Item column. After preparing the journal entries we have to post them to the ledgers. The third step in the accounting cycle is the posting of these journal entries to the ledger T-accounts.

Posting means to transfer the information calculated in the journals to the various T-accounts in the ledger. If a business records revenues when earned regardless of whether cash has been received and records expenses when they are incurred the accounting system is an. Move each journal entry to its individual account in the ledger eg Checking account Use the same debits and credits and do not change any information.

Prepare the Adjusted Trial Balance. Adjusting in the Posting Reference column. When posting an adjusting entry to the general ledger write Oa.

4 5 -Adjusting Entries Use worksheet 2 6. Companies are required to adjust the balances of their various ledger accounts at the end of the accounting period in order to meet the requirements of the various authorities standards. When posting an adjusting entry to the general ledger write adjusting in the item column.

When adjusting the balance for a sub-ledger refer to the Balance on TradeTransaction field at the top of the page. It is the book of final entry. A business shows the aging of its assets through depreciation.

Calculate account balances in your general ledger. Answer Explanation1 Here is a tip. Read more AJE are the entries made in the accounting journals of a business firm to adapt or to update the revenues and expenses accounts according to the accrual principle and the.

It provides evidence that the total debits in the general ledger equal total credits 3. 2 at the end of the day week or month. Instead follow the steps below to post journal entries to the general ledger.

Keep in mind that when posting a journal entry you will still need to allocate the adjustments posted against sub-ledger accounts. T-Accounts are named so because it shapes like the English Word T. Journalize the adjusting entries on page 5 of the general journal.

Increase in owners equity withdrawals and expenses investment additional investment revenueincome POSTING JOURNAL ENTRIES IN THE LEDGER The ledger is the group of accounts used by the company. If a business records revenue when it is received and records the purchase of a building as an asset and makes adjustments to allocate the cost of the building over many accounting periods the business accounting system is an. If you landed directly on this page but are struggling with accounting.

89 Closing Entries use worksheet 2 9. The choice is a matter of personal taste. Posting adjusting entries to the ledgers and re-balancing the accounts.

The following state ments pertain to a trial balance 1. Each year a portion of the original cost of an asset is written off as an expense and that change is. Wages earned but not paid as of November 30 190.

Post Closing Entries to the General Ledger. It is the second step of accounting cycle because business transactions are first recorded in the journal and then they are posted to respective ledger accounts in the general.

Accounting Cycle Example 2 Posting Adjusting Entries To The General Ledger Youtube

Lesson 6 4 Journalizing And Posting Adjusting Entries Ppt Download

Journalizing Posting Adjusting Entries From Worksheet Professor Victoria Chiu Youtube

Solved Journalizing And Posting Adjusting Entries A Journal And General 1 Answer Transtutors

0 Response to "When Posting an Adjusting Entry to the General Ledger Write"

Post a Comment